Part

01

of one

Part

01

2023-2024 Media Landscape

Key Takeaways

- Immersive and Connected Digital Media Experiences: Digital media is increasingly becoming a significant part of people's lives, particularly among younger generations. Integrating TV, gaming, and user-generated content create a tapestry of entertainment, community, and meaning. This trend is driven by changes in consumer behavior and the growth of digital media platforms.

- Highly Dispersed Consumption among Adults 35+: Adults aged 35 and above, including millennials, have diverse media consumption habits. This demographic has significant buying power, and their media habits require advertisers to distribute their spending across different platforms.

- A decline in Subscription Video-on-Demand (VoD) in favor of Ad-based VoDs: The growth of SVoD services has slowed as consumers seek cheaper options. In response, streaming providers are introducing Ad-based VoDs. This trend is driven by reduced consumer spending and the desire for more affordable entertainment options.

- Increased Use of Social Media in the Travel Industry: Social media is becoming a crucial tool for travelers for research and creativity. Travel companies leverage social media to engage directly with customers, making it a cost-effective way to increase connection and reach.

- Increase in Budget Travel Stories: Economic pressures are leading to a rise in budget travel stories. Destinations and travel companies are highlighting cheaper ways of travel to cater to this growing demand.

Introduction

This research identifies 4 current trends around media consumption and media channels in 2023. Provided are trends around media consumption, including trends specific to media consumption by adults 35+, trends around the use of different media channels or formats for advertising, and media consumption or media channels trends specifically related to the travel community. A description, driving factor, and example are provided for each trend. These include the rise of immersive and connected digital media experiences, the dispersion of media consumption habits among adults aged 35 and above, the decline in Subscription Video-on-Demand (SVoD) in favor of Ad-based VoDs, the increased use of social media in the travel industry, and the growing popularity of budget travel stories. These trends are reshaping how consumers interact with media, influencing the strategies of media and entertainment companies, and setting the stage for the industry's future.

The research further identifies and describes 3 predictions around media consumption and media channels for 2024. Provided are predictions about media consumption, the use of different media channels or formats for advertising, and media consumption or media channel predictions specifically related to the travel community. The predictions include increased interactive and personalized advertisements, improved digital experiences and entertainment, and increased investment in free ad-supported streaming TV. These trends and predictions for 2024, including the increase in interactive and personalized advertisements and the rise of free ad-supported streaming TV, provide a road map for the future of media consumption. Understanding these trends and predictions will be crucial for media and entertainment companies navigating the rapidly evolving media landscape.

Trend 1: Immersive and Connected Digital Media Experiences

- Description: Digital media allows people to see new places, create bonds with people in distant lands, and allow people to feel like there is always more out there. Users can reach communities, content creators, and experiences with a swipe or a click. For many, digital spaces are a real and meaningful part of their lives, which support their emotional and social needs. According to Deloitte, about a third of American citizens consider online experiences as meaningful and that they can replace in-person experiences, and half of Millennials and Gen Zs completely agree with this statement. In the U.S., approximately half of the millennial and Gen Z population claim they spend more time socializing on social media than in the actual world. 40% acknowledge that they socialize more in video games than in the physical world.

- Movies and TV shows are immersive and have their own communities. They also live beside gaming and social media. User-generated content and video games blend content diversity and experiences through collaborations, competitions, adventures, shopping, music, and an endless stream of personalized content that can be used to create viral moments. This variety in media increases utility, engagement, interactions, and sharing to create more connections and immersion. Millennials and Gen Zs tend to watch user-generated content and play video games for entertainment, connection, and immersion. Older generations, including Gen X, are more likely to feel more immersion by watching movies and TV shows and are less likely to experience a sense of community from movies and TV. It should be noted that all generations value music which traverses across user-generated content, film, TV, and gaming.

- Driving Factor: Changes in consumer behavior, especially in younger generations, and the emergence and growth of digital media platforms drive this trend. Sharing and interacting with others helps create more connections and is an avenue for immersion.

- Example: Deloitte's 2023 Digital Media Trends report discusses how younger generations are transforming the media and entertainment landscape as they seek more connection, immersion, and value from their digital media activities. This trend is forcing media and entertainment companies to rethink their strategies to reach and engage people across media, deliver more value and enjoyment, and establish deeper relationships amidst so much competition and change. In 2022, The New York Times bought Wordle, a word guessing game. Through the purchase, The New York Times plans to leverage gaming to increase its digital subscriptions to 10 million by 2025. Additionally, it will encourage repeat visits even when users do not want to read articles increasing their daily users, immersion, connectedness, and increase their digital media experiences.

Trend 2: Highly dispersed consumption among Adults 35+

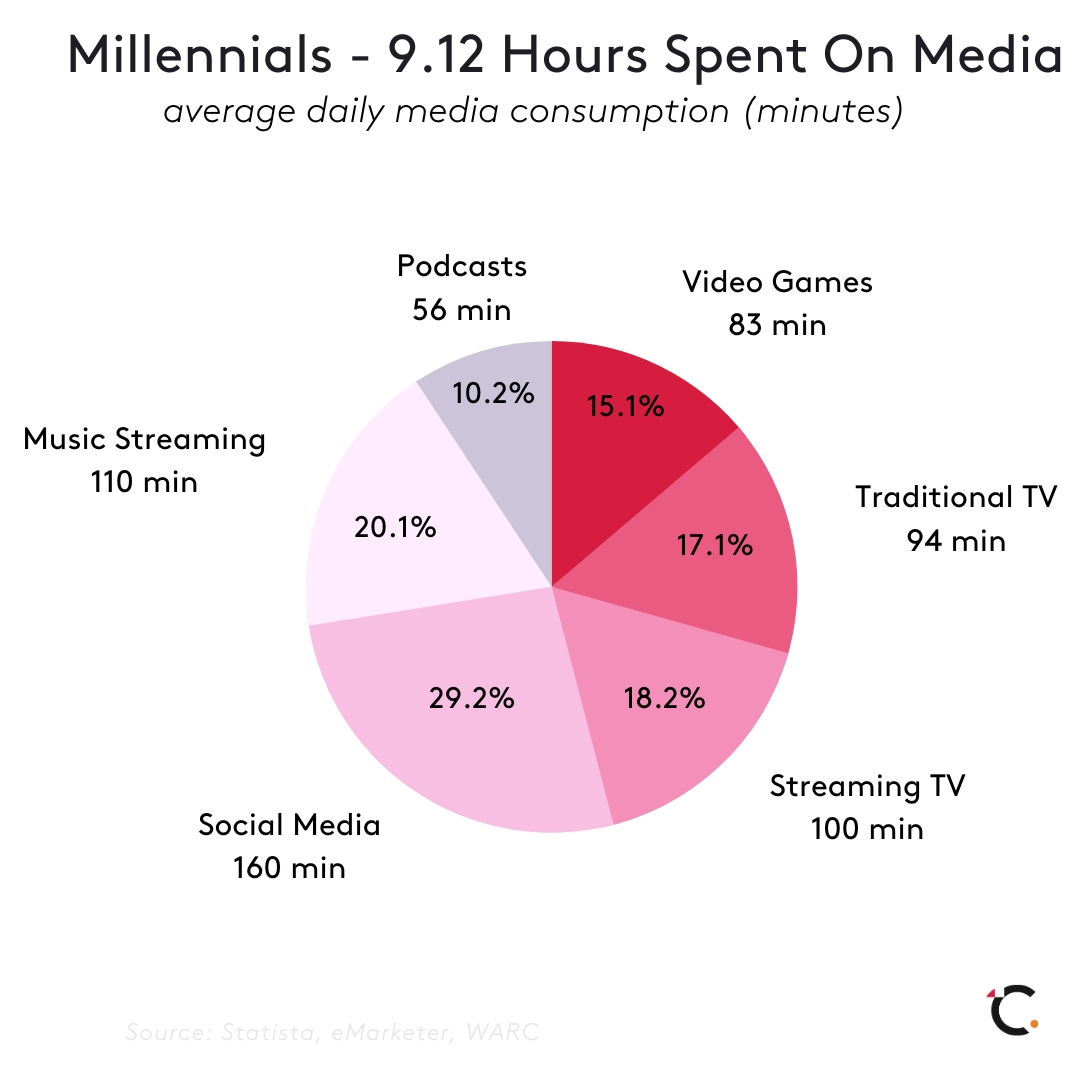

- Description: Adults who are 35+ can be classified as millennials. As the embodiment of digital disruption, they have the most dispersed media consumption habits, epitomized by the transition from analog to digital and sharing media habits from the younger and older generations. An article in the Drum reported that Millennials spent 9.5 hours on average consuming media. The demographic's dispersed viewing habits require advertisers to distribute their spending on different platforms.

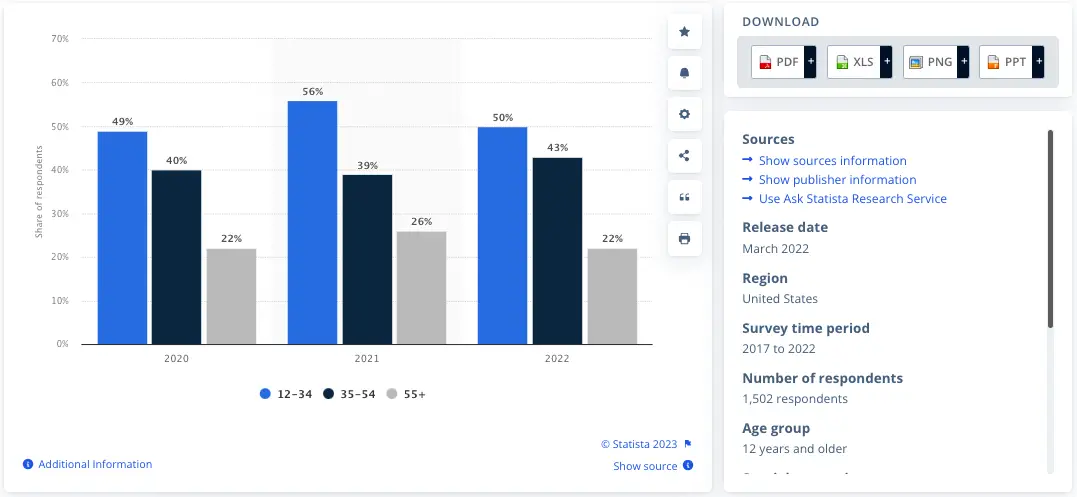

- The demographic also has a lot of buying power as they are in their prime working years, have children, purchased houses, or are experiencing a midlife crisis. Compared to other generations, millennial podcast listening has increased over time from 39% in 2021 to 43% in 2022, with the trend expected to increase.

- Millennials' readership of print magazines is low; they also listen to online radio and podcasts more than traditional radio. This is due to accessibility rather than the media itself. 60% of Millennials subscribe to music streaming services, while 88% of Millennials subscribe to a video streaming service. Millennials also spend 105 minutes per week watching video content using their smartphones, and they also rate Amazon Prime Video, Hulu, and Netflix as indispensable videos, indicating the popularity of streaming among the demographic.

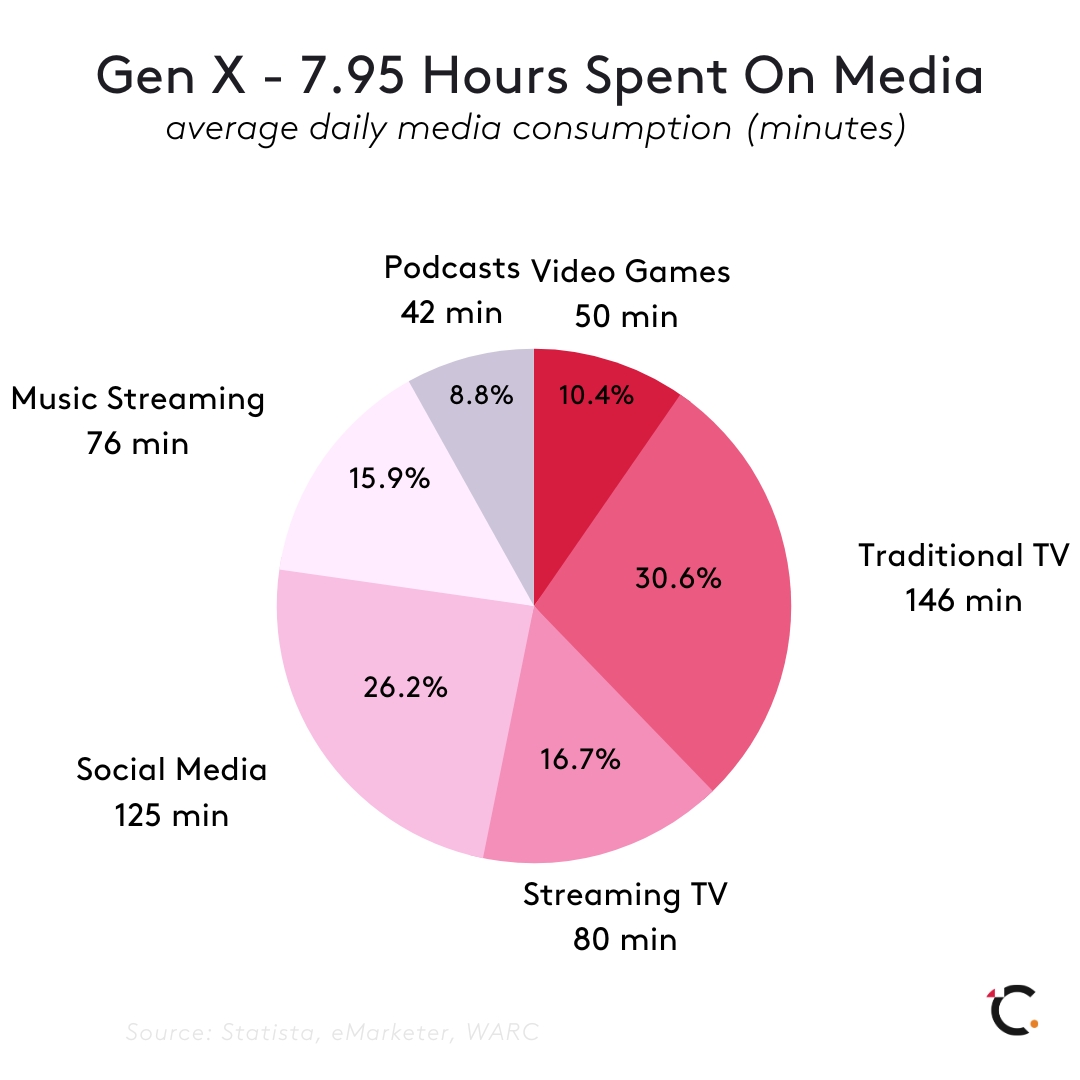

- The Gen X (45-60) population's media consumption is skewed toward traditional media, and they are more likely to have paid TV bundles and new TV streaming subscriptions. According to the World Economic Forum, they have the highest disposable income compared to any generation. Advertising brands should leverage traditional TV and distribute their spending to maximize their reach.

- Driving Factor: The shift in media consumption habits among millennials, including adults 35+, could be attributed to various factors. These include the rise of digital media platforms, changes in lifestyle and work patterns, and the convenience and accessibility of radio and other media.

- Example: In the U.S., YouTube (33%) and Spotify (24%) are among the largest podcast streaming services, controlling more than 50% of the listener share. 32% of millennials use YouTube, while 22% use Spotify and 12% use Apple Podcasts to listen to podcasts.

Trend 3: Decline in Subscription Video-on-Demand (VoD) in favor of Ad-based VoDs.

- Description: The media industry has grown to become a multi-trillion-dollar industry that greatly benefits from internet connectivity, improving technologies, and the need for on-screen content. The result of such advancements has been the rise of Subscription Video-on-Demand (SVoD) with companies like Netflix and Disney Plus. However, subscription has continually slowed as more consumers opt for cheaper options. As such, streaming providers have resulted in Ad-based videos-on-demand. According to Deloitte and Dentsu, most consumers say that SVoD services are expensive and would prefer reducing their subscriptions.

- The churn rate for SVoD is 44% overall, and for Millennials and Gen Z's, the value increases to 62% and 57%, respectively. Millennials and Gen Z often pay for Video-on-Demand subscriptions to watch a specific show or movie, cancel immediately after they are done, and repeat the process when a new movie or season is available. With the decline in Video-on-Demand subscriptions, companies like Netflix and Disney Plus are launching ad-based VoDs to retain their existing customers and attract new customers. Over time, ad-based video streaming platforms and subscriptions will increase as Netflix and Disney Plus add ad-based tiers.

- Driving Factor: The decline in video-on-demand subscriptions trend is slowing down due to reduced consumer spending. This is due to the rising inflation rates, looming recession (page 4), and viewers preferring free or cheaper sources of entertainment. As such, streaming platforms are becoming increasingly competitive and innovative to allow them to create creative and targeted messages that can be used to market Ad-based VoDs.

- Example: At the end of 2022, Netflix and Disney Plus announced the introduction of ad-based user tiers. Netflix's original principle was that users paid for a service and, in return, experienced ad-free programming. The principle was based on their DVD rental history; there are no ads when watching an episode or movie on a disk. However, stagnating numbers and increased competition (page 7) from other streaming platforms have necessitated the need for ad-based user tiers.

- Adding ad-based user tiers can increase subscriber numbers and additional revenues from advertisers that want to promote their services or products on the platform. Similarly, Disney Plus's ad-based tiers will also increase its revenues. Netflix has surpassed 1 million subscribers in the U.S., and its user base has increased by 500% since its launch and 50% in its second month. Additionally, in the U.S., Bloomberg reports that most ad-tier signups are new customers and not customers that immediately changed plans, and the tier accounts for 20% of all new sign-ups. Analysts project that over time, Netflix will see its customer base increase by 15 million and 30 million customers.

- Connected TV has also evolved, implying that advertising can be fine-tuned to be more granular for broadcast advertising. Additionally, the formats used can be interactive and innovative. It is also possible to interact with advertisements, send them to the user's phone and create shoppable advertisements where users can use a remote to make purchases on their screen. Through Amazon Ads, Amazon announced that it would introduce virtual product placement in its programming and apply special effects to insert brands into programs during post-production.

Trend 4: Increased Use of Social Media in the Travel Industry

- Description: It helps create an avenue where people can research destinations and modes of transport and share experiences through photos and videos. Statista reports that 36.5% of travelers use social media for research and creativity. This trend is prevalent among younger travelers, with 40% of millennials and 60% of Gen Zs using social media for travel purposes. Compared to traditional outlets, travels agent (29%), media publications, like magazines and newspapers (26%), and entertainment such as movies and TV shows (25%), social media is used more for inspiration.

- For many travel companies, social media is a cost-effective and helpful way of directly engaging with customers. As such many are investing resources and time for increased connection and reach. The "#travel" tag on TikTok has over 74.4 billion views, while Instagram posts related to travel amount to more than 624 million posts.

- Driving Factor: This trend is driven by travelers becoming more aware of the power of social media and how it can help them find new locations and new ideas of places that they want to visit.

- Example: Ryanair has increased its TikTok followers to over 1.6 million, increasing its brand engagement. It has done this by capitalizing on viral content like memes which people find relatable and exciting. The strategy allows Ryanair to stay relevant and helps differentiate it as an airline capable of cultivating its own unique personality using engaging content.

- Destination Canada used Expedia Group’s social media channels to create a campaign targeting American travelers. For their campaign, they created a 15-second TikTok video highlighting "5 things not to miss in Canada". The campaign reached over 2 million users from their target U.S. market and generated more than 3.5 million impressions to show that such content can produce impressive results.

Trend 5: Increase in Budget Travel Stories

- Description: The threat of a recession and increased inflation budget travel stories will become more mainstream. Destinations must angle their stories and campaigns to highlight cheaper ways of travel and visiting even when some destinations are not typically budget-friendly.

- Driving Factor: This trend is driven by the many economic pressures many U.S. travelers face resulting in increased travel budgets and a narrowing of travel options.

- Example: Skyscanner, a metasearch engine and travel agency, uses travel aggregators to provide travelers with options to get the most affordable hotels, rental cars, and flights to cater to the growing demand for budget travel.

Predictions for how media consumption and/or use of media channels may change in 2024

Prediction 1: Increase in Interactive and Personalized Advertisements

- Consumers will expect interactive and personalized ads based on their preferences on different media channels and formats in 2024. Personalized advertising will be more advanced, leveraging AI and data to deliver highly specific and relevant ads. This prediction is a continuation of current trends. AI, specifically generative AI, can change ads based on consumer identity and context. Large-scale editing, personalization, and confirming quality is currently an impossibility implying that ads would not have a human review element. Collecting consumer data required to create such ads is still challenging due to cookie depreciation, AppTrackingTransparency, and regulatory hurdles, which must be overcome to utilize generative AI fully.

- AI can also personalize user experiences in mobile applications and websites by personalizing product recommendations or user interfaces to match a business website and user interests. It can also analyze ad performance and predict the ads that will be successful, which can help businesses make informed decisions on their advertisement strategies and budgets.

- According to eMarketer, the projected ad spending of US digital retail media in 2023 is expected to increase to $51.36 billion, a 25.8% increase. In 2024, it will constitute approximately 20% of the total digital ad spending as advertisers find solutions to addressability depreciation as they invest in first-party data. This has resulted in Walmart DSP partnering with Innovid to deliver personalized, optimized, and interactive ad experiences similar to connected TV (CTV).

Prediction 2: Increased investment in free ad-supported streaming TV

- Big streaming platforms like Netflix and Disney Plus announced they would introduce ad-supported subscription tiers. The ad-supported subscription tiers are attractive to price-conscious subscribers who are willing to trade ad-free viewership for free or discounted video-on-demand. In 2024, free ad-supported streaming TV investments and services will increase. This prediction is a continuation of current trends.

- According to Deloitte, by the end of 2023, most subscription-based video-on-demand (SVOD) services will launch ad-based tiers to complement ad-free options. By the end of 2024, about half of the providers are projected to offer free and free ad-supported streaming TV services. Additionally, by 2030 most online video service subscriptions will be wholly or partially funded.

- The prediction is driven by the increased use of smart devices, such as mobile devices and streaming boxes, which have increased access to free streaming content. High-quality content availability from established studios and networks increased the appeal of free streaming services. Additionally, advancements in ad personalization and targeting make it easy for advertisers to market to certain audiences, driving increased investments in the market. The trend of canceling cable TV subscriptions will drive the growth of the free ad-supported streaming TV market. According to eMarketer, in 2024, the number of AVOD viewers will increase to 59.5%, reaching 158.5 million viewers.

Prediction 3: Improvement of Digital Experiences and Entertainment

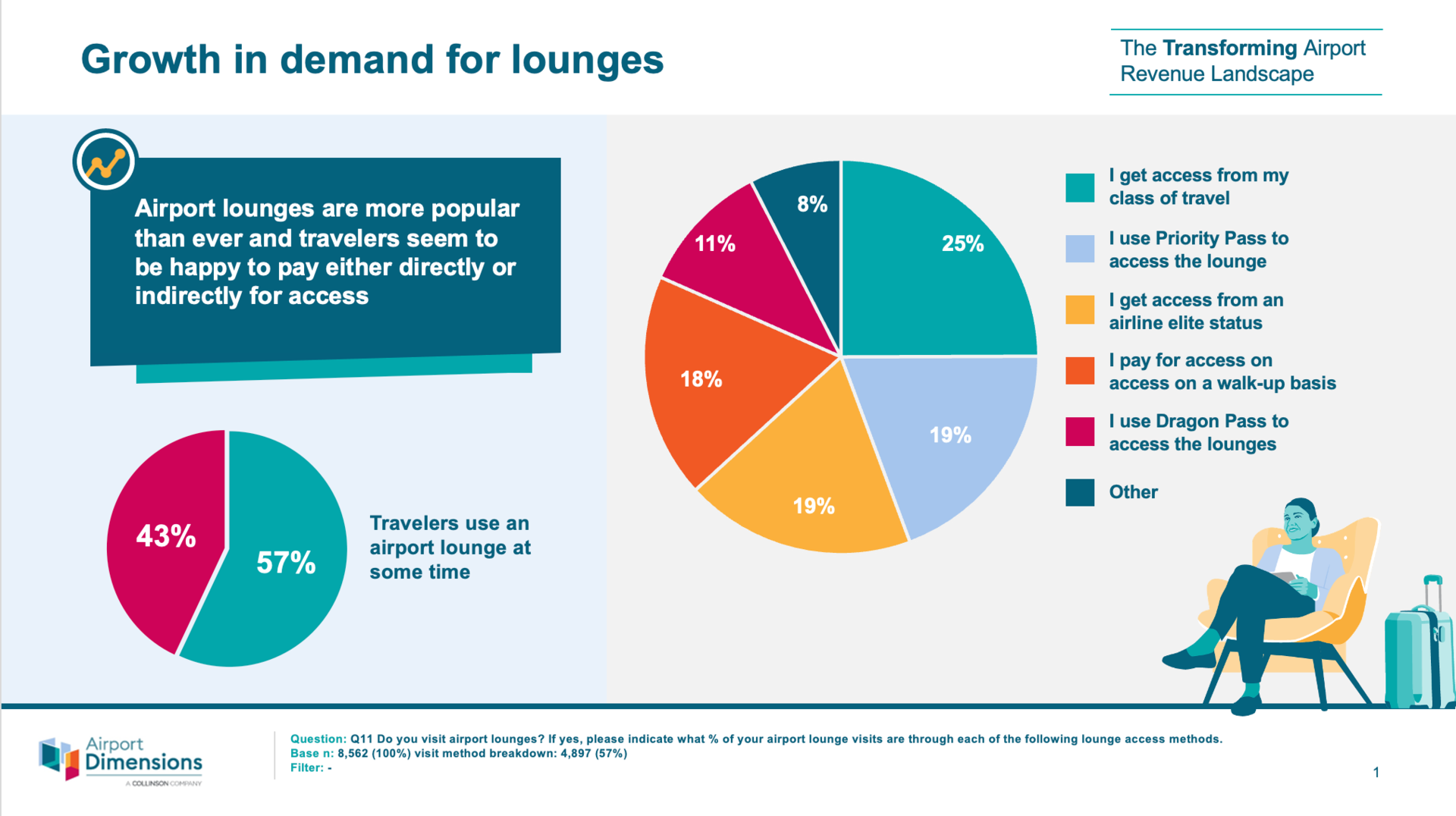

- According to Airport Experience Research by Airport Dimensions’, 57% of travelers visit the lounge, and the demand for the lounge is increasing, indicating a public appetite for improved retail experiences and entertainment when using such spaces, with many customers willing to pay for the extra services. Typically, users are provided with accessory booths and public computers, which are continually changing and will continue to change in 2024. This prediction is a continuation of current trends.

- Delta Airlines is currently experimenting with Parallel Reality and experiences to facilitate and improve the passenger experience. The technology allows up to 100 customers to view personalized flight data tailored to the trips on one shared digital screen simultaneously, making their journey easier in the airport. Other airlines are expected to improve their airport and lounge digital experiences and entertainment.

- Additionally, AI chatbots are currently being developed and used to complement mass airport deployments. They are fitted with facial recognition algorithms, which can add a personal touch to human-to-machine interaction. The machines will be programmed to sing the benefits of sanitization and personal hygiene.

Research Strategy

For this research, we leveraged the most credible sources of information available in the public domain, such as Deloitte, Statista, The New York Times, The Drum, We Forum, and more. Using this strategy, we found most of the requested data points. However, we could not find information specific to the 35+ demographic. However, knowing that adults aged 35+ fall are classified as Millennials, we expanded our search to include Millennials and provided millennial-related consumption data as it also applies to the demographic (adults aged 35+).